How to integrate Xero with Lovat

L’Invoice & Xero integration allows you to seamlessly send invoices created in Xero to L’Invoice for Peppol-compliant invoicing.

L’Tax & Xero integration enables seamless uploading of international invoices to the transactions section, making it easier to prepare tax returns and include all your sales.

Example:

Arketto Ltd (UK) sells books and audiobooks worldwide. The company receives subscriptions via Stripe and wire transfers to its bank account. Arketto integrates with Stripe and uploads B2B transactions from both Stripe and Xero. The company holds an EU VAT number and prepares VAT returns using L’Tax.

Integrate your Xero account with your Lovat account. Lovat for Xero allows to get automated tax calculations on invoices.

In order to get integration of Xero with your Lovat account for tax compliance purposes, please complete the following steps:

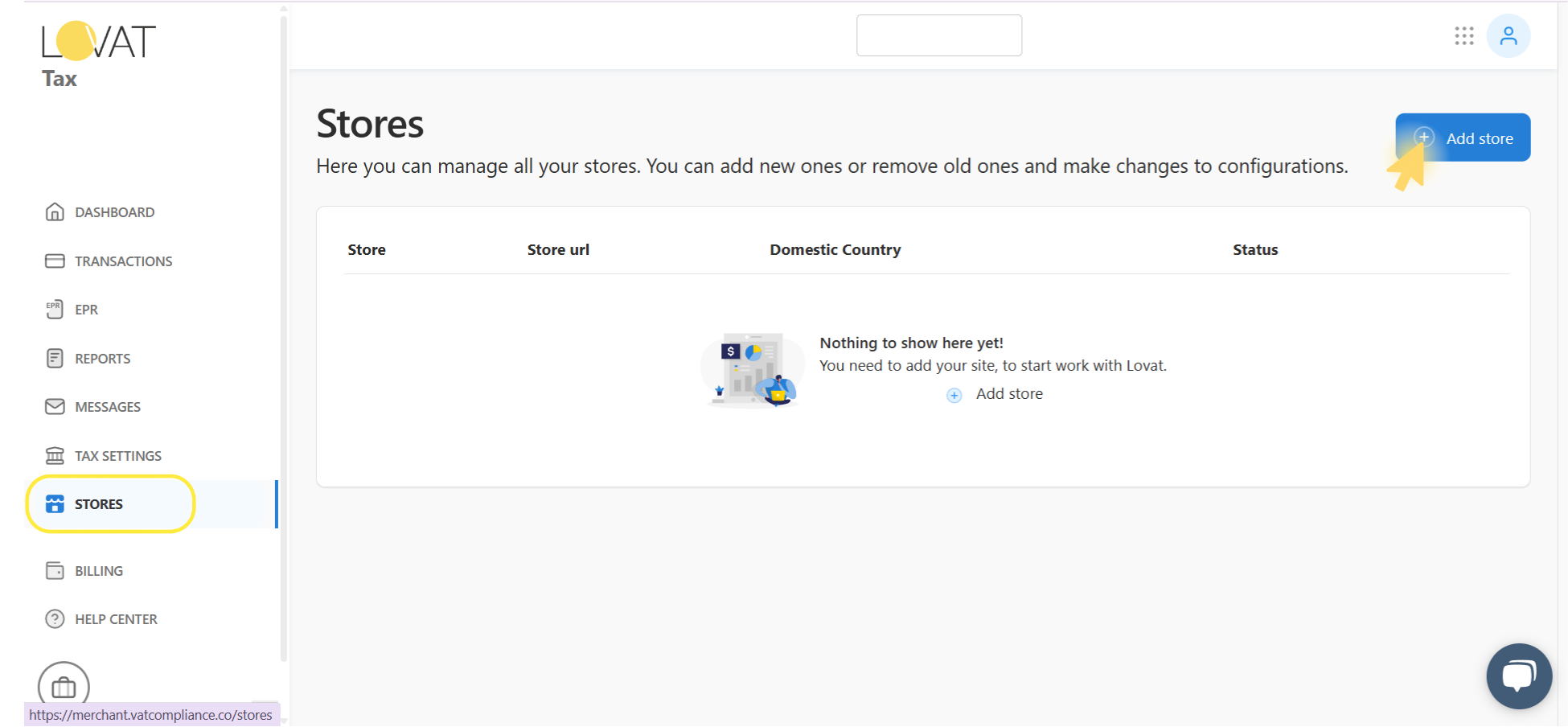

2. Connect Xero to Lovat

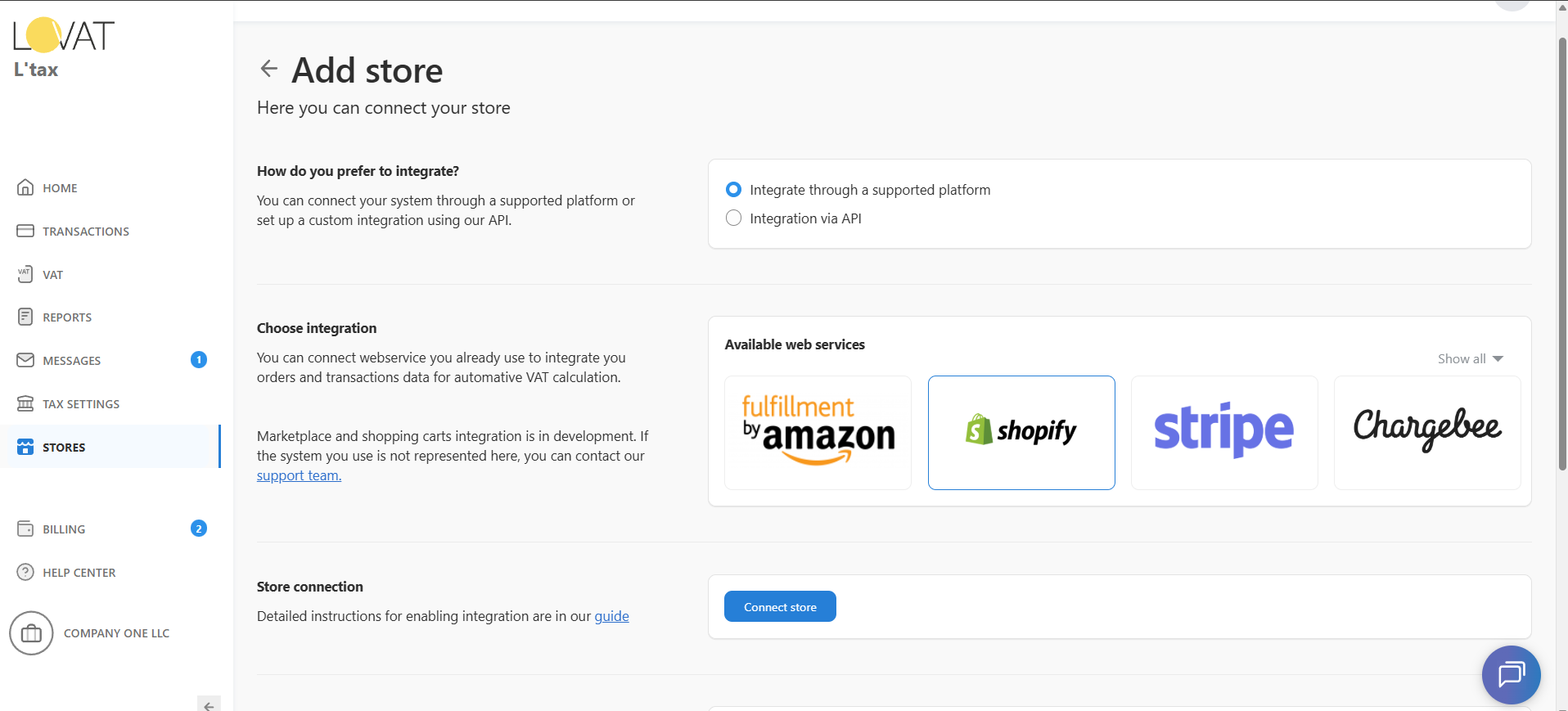

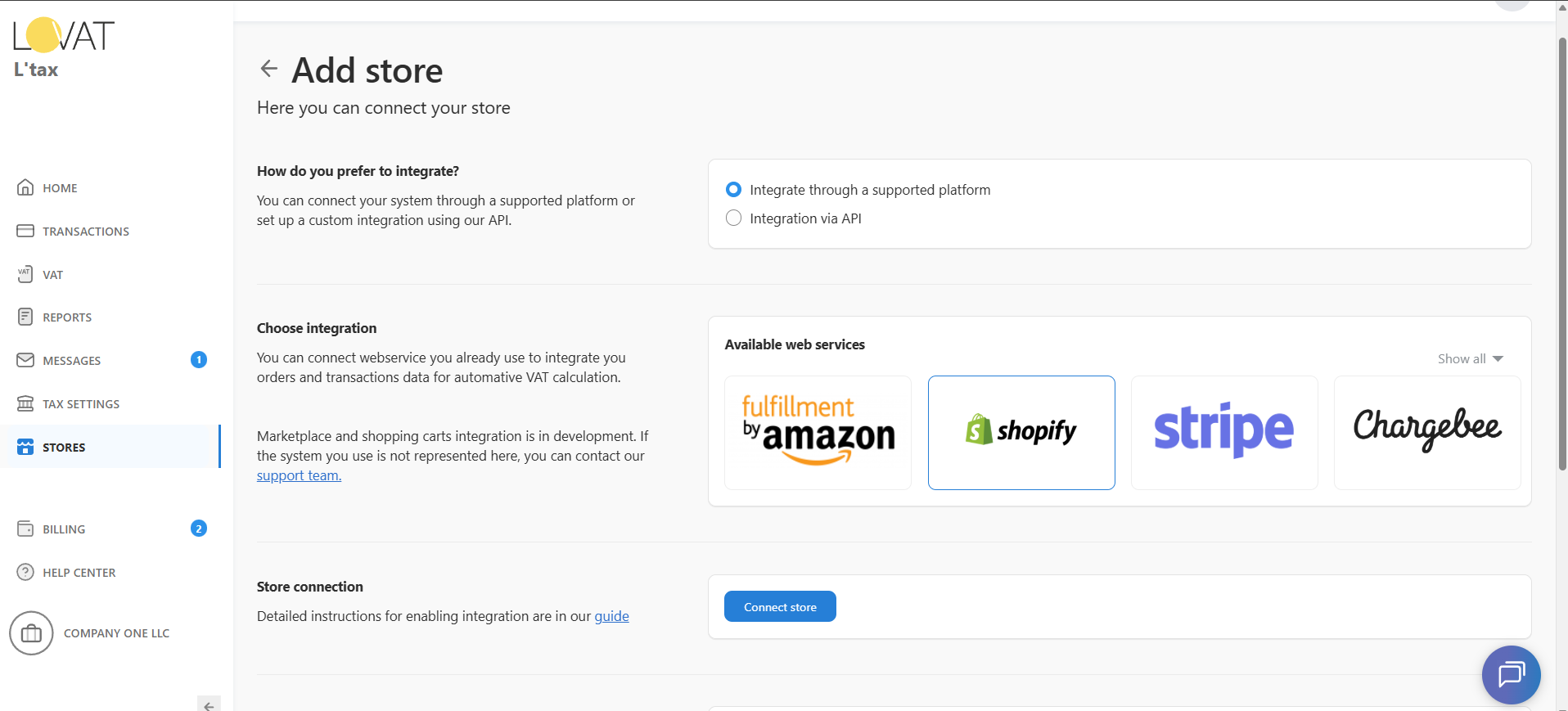

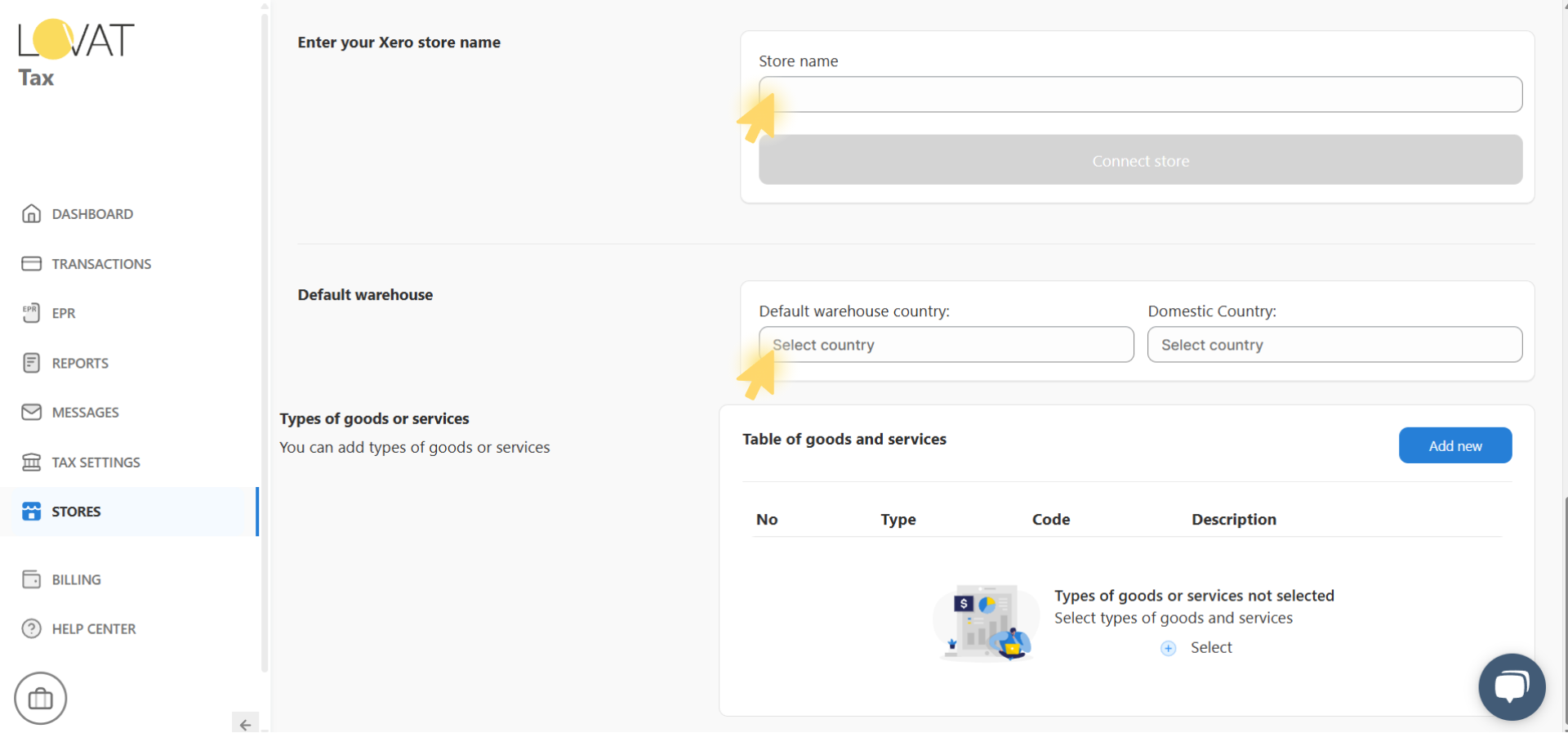

On the Add store screen, specify how you sell:

- Under “How to you prefer to integrate?”, select “Integrate through a supported platform”.

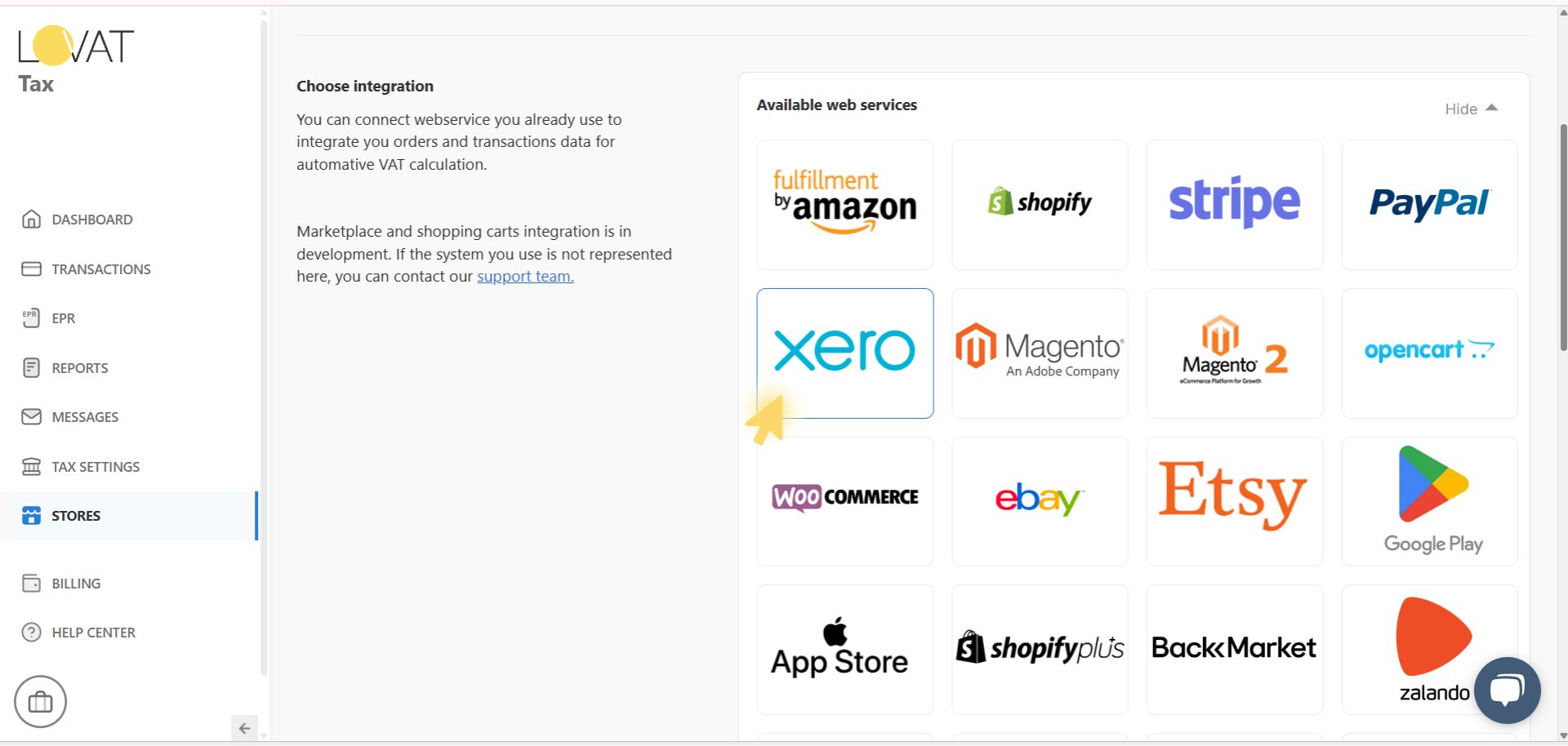

- In the Available web services section, click Show all to view all integration options.

- Choose the platform you want to connect (in our case — Xero).

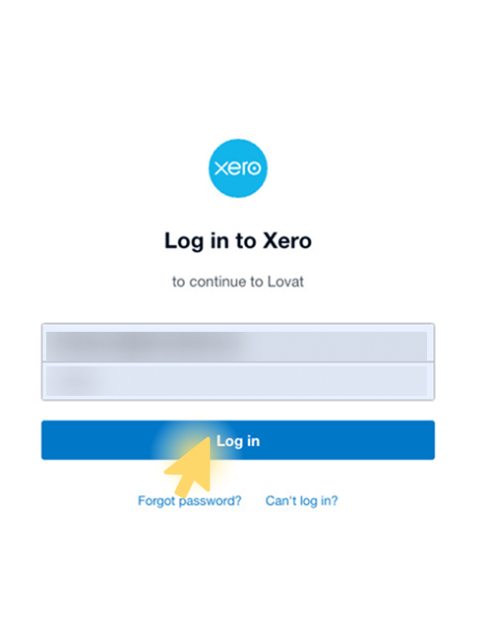

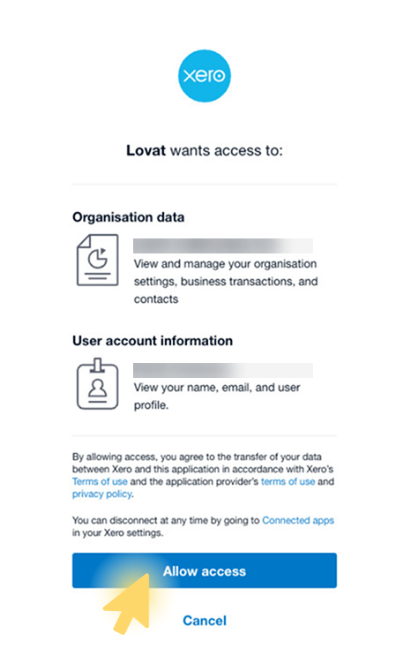

After logging in to Xero, you’ll see a request screen asking you to authorize Lovat to access your account.

Review the requested permissions:

- Organisation data

- User account information

Click Allow access to approve and continue the integration.

You can revoke this access anytime via your Xero connected apps settings.

5. Integration Lovat with Xero completed!

After confirming access, your store is successfully connected to Lovat.

From now on, your Xero account data (transactions, orders, reports) will sync automatically for tax calculation and reporting.

Still have questions?

Contact us support@vatcompliance.co