Credits (Add-ons)

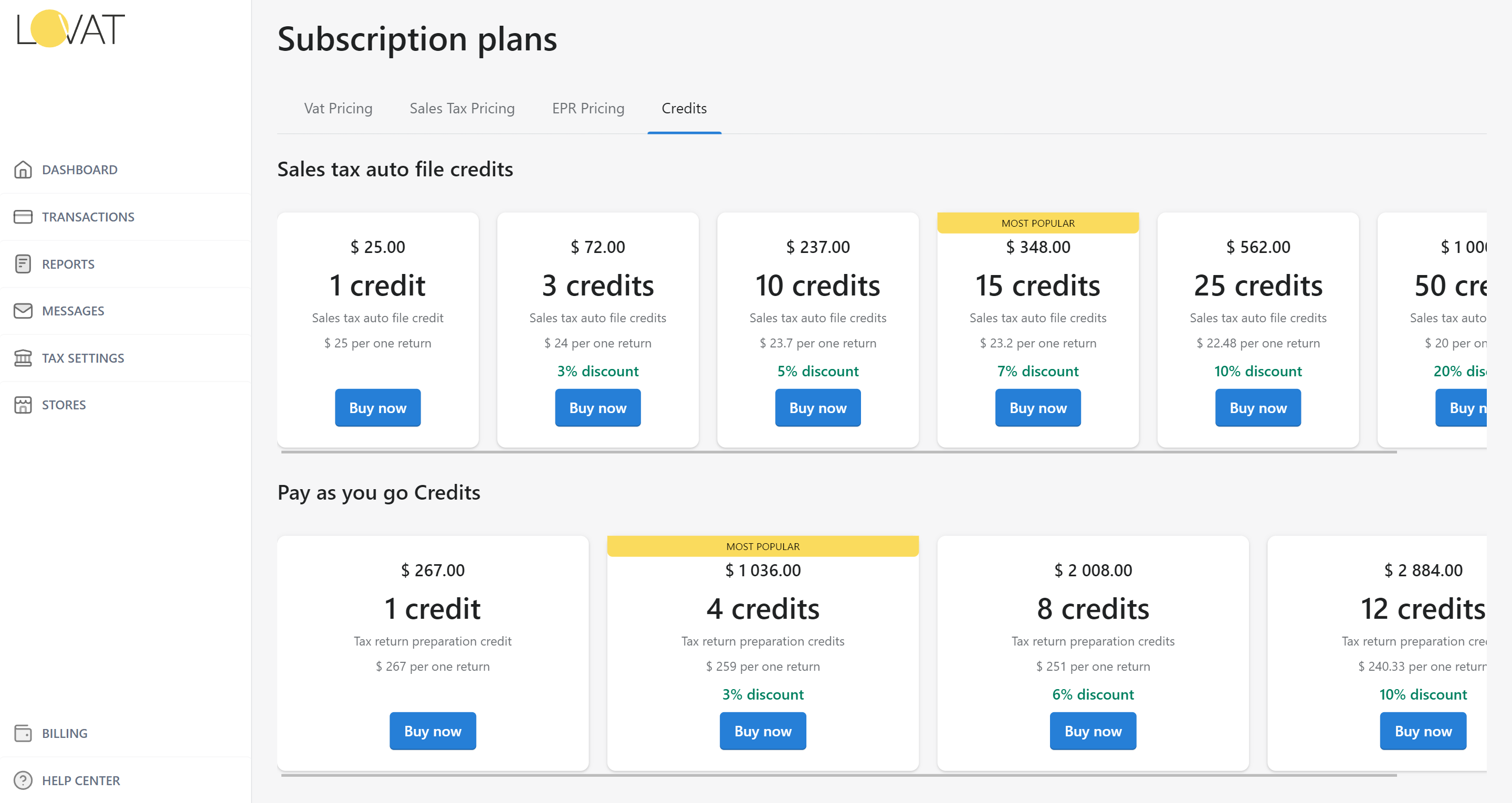

Credits Units of payment that are used for submitting Sales tax returns, VAT returns, or EPR reports. Each return costs one credit.

- Auto-submit Credits

Go to your Plan & Billing page to purchase AutoFile Credits inside your Lovat account.

- From the Add-ons section, click Add credits to view the available options.

- After clicking “Select” on the bundle of your choice, you can review and confirm your purchase on the next page.

- Your remaining credits are indicated in the Usage and Plan section.

- Pay as you go Credits

This type of credit allows you to buy credits to file your tax returns manually by our tax team without subscribing to a monthly or yearly plan. We recommend this option if you need support for your tax preparation.

- EPR credits

EPR reporting plans include 1 auto-submit credit- that allows you to submit one EPR return per year. If you need to submit your EPR reports more frequently than once a year you may buy EPR credits. Buy packs of EPR credits to send your EPR reports to a specific eco-organisation. The price depends on the volume of credits and the type of EPR registration.

Good to know

- Add-ons can be used at your pace: they do not expire and will remain valid until you use them all.

- You cannot get a refund for add-ons. Make sure you purchase the amount of add-ons you need to avoid wasting them.

- When Credits are included in your plan, credit is issued on your membership’s renewal date for yearly plans. This may be once every 3 months if 4 credits per year in your membership plan. Your renewal date is indicated in the Usage and Plan section.

- Membership credits do not expire as long as you have an active membership, however, there is a limitation on how long you can rollover your credits. The maximum rollover period for Credits is 36 months.