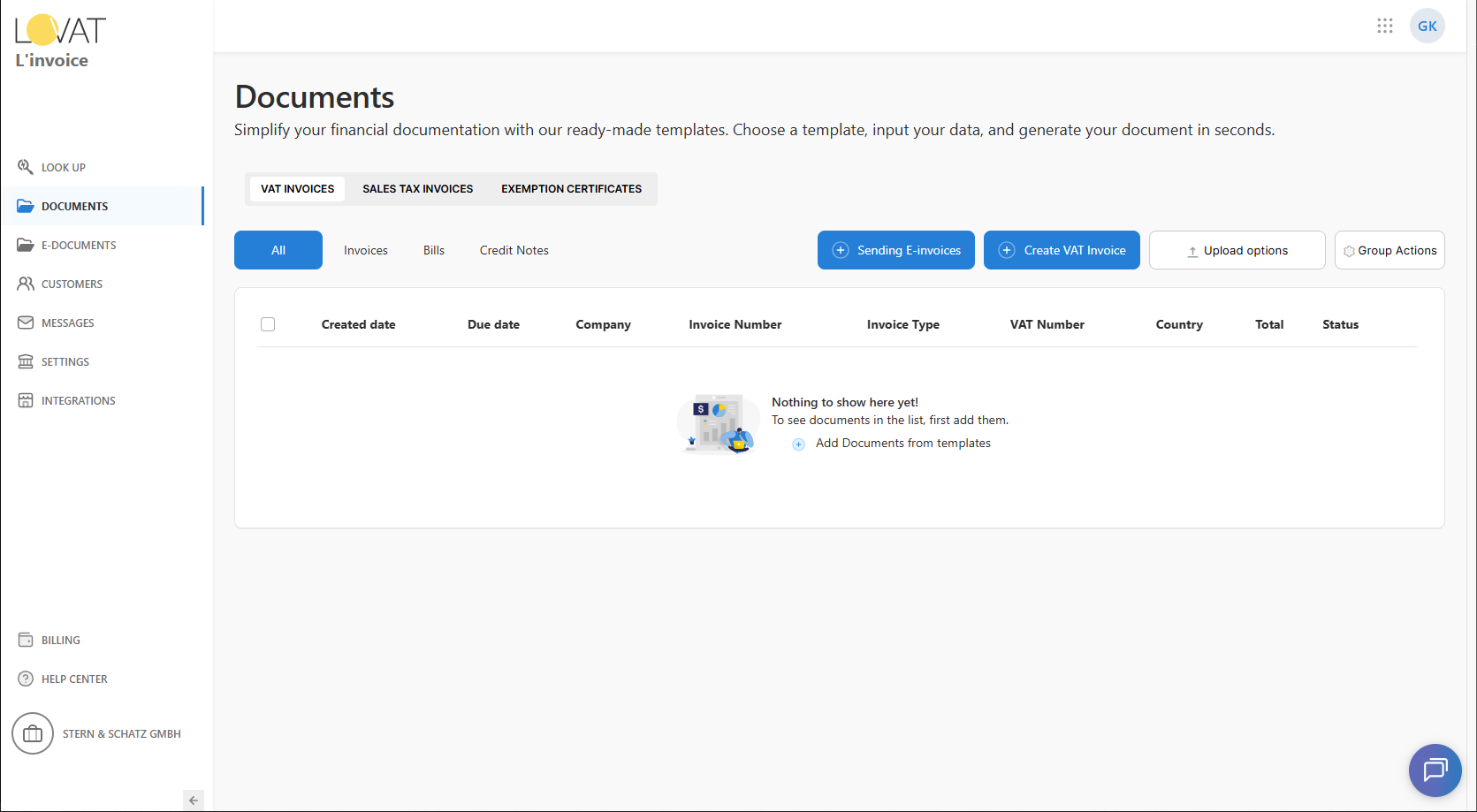

The L’Invoice invoicing module allows you to generate VAT-compliant and Sales Tax–compliant invoices in just a few clicks. Choose a document type, fill in the required customer and product details, and instantly generate a ready-to-send invoice.

Why create invoices in Lovat?

By using L’Invoice, you ensure that your invoices meet Peppol and VAT requirements, reduce manual work, and automate tax calculations. The platform helps you stay compliant while keeping all your documents in one place.

1. Prepare to create your first invoice

To start creating invoices, go to your Lovat platform and log in using your credentials.

Once you’re in:

- Log in to your Lovat account.

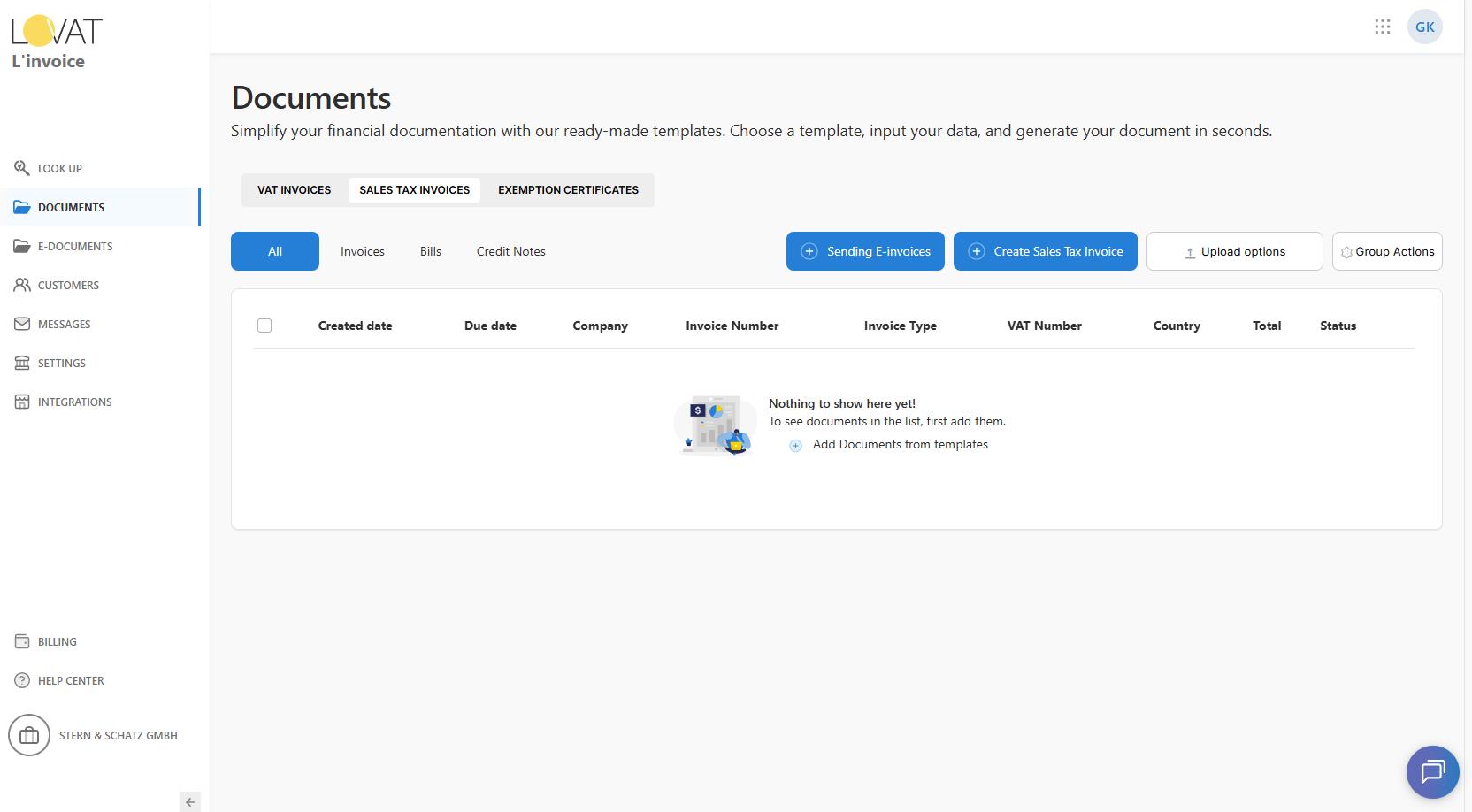

- In the left-hand menu, click Documents.

- Choose the invoice type you need:

- VAT Invoices (for cross-border B2B in EU or VAT countries)

- Sales Tax Invoices (for US and domestic tax rules)

- Click Create VAT Invoice or Create Sales Tax Invoice to begin.

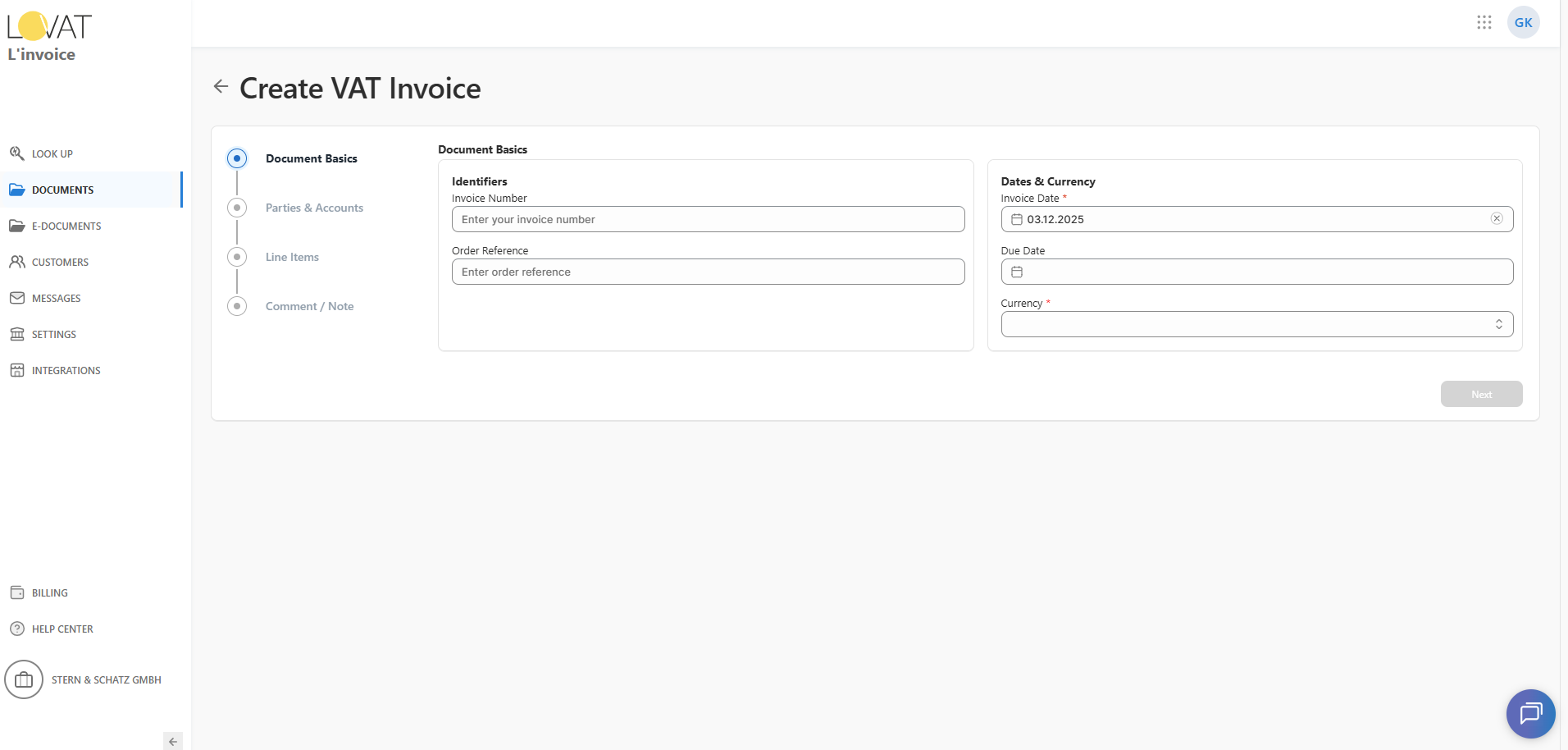

Step 1 — Document Basics

1. Document Basics

The first step of creating a VAT Invoice (Sales tax invoice) is filling out the basic document information.

This section contains identifiers and date-related fields that define your invoice. Some fields are mandatory and must be completed before you can proceed.

Mandatory fields

- Invoice Date – the date when the invoice is issued.

- Currency – select the currency in which the invoice will be created.

Optional fields

- Invoice Number – if not provided, L’Invoice can generate an invoice number automatically according to your numbering settings.

- Order Reference – any external reference or purchase order number related to the transaction.

- Due Date – the date by which the customer must pay the invoice.

After entering the required information, click Next to proceed to the “Parties & Accounts” step.

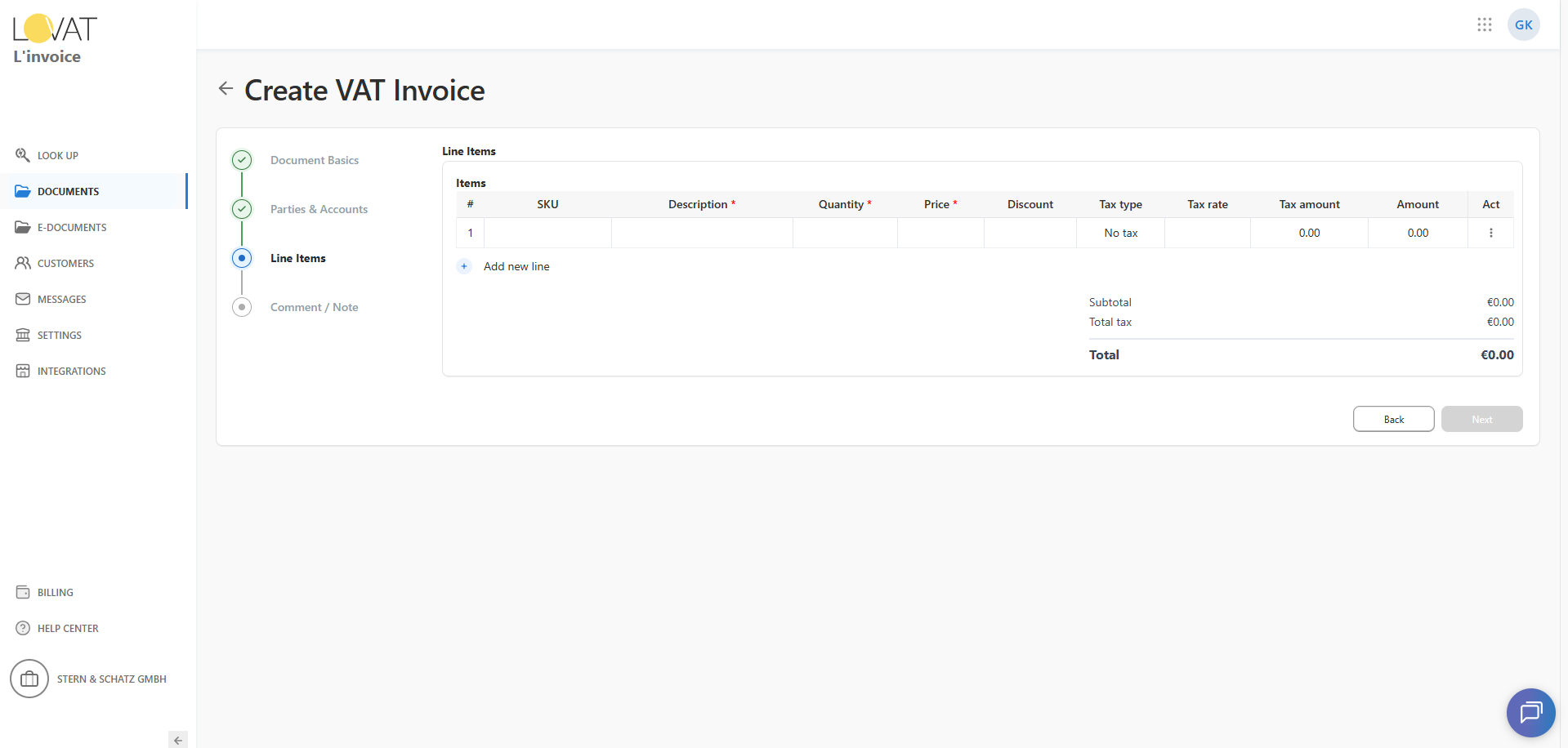

Step 3 — Line Items

In this step, you must add all products or services that will be included in the invoice.

At least one line item is required to proceed.

Adding Line Items

Add new line

Click “+ Add new line” to create an empty row directly in the table.

The row will appear immediately, but it is not filled yet.

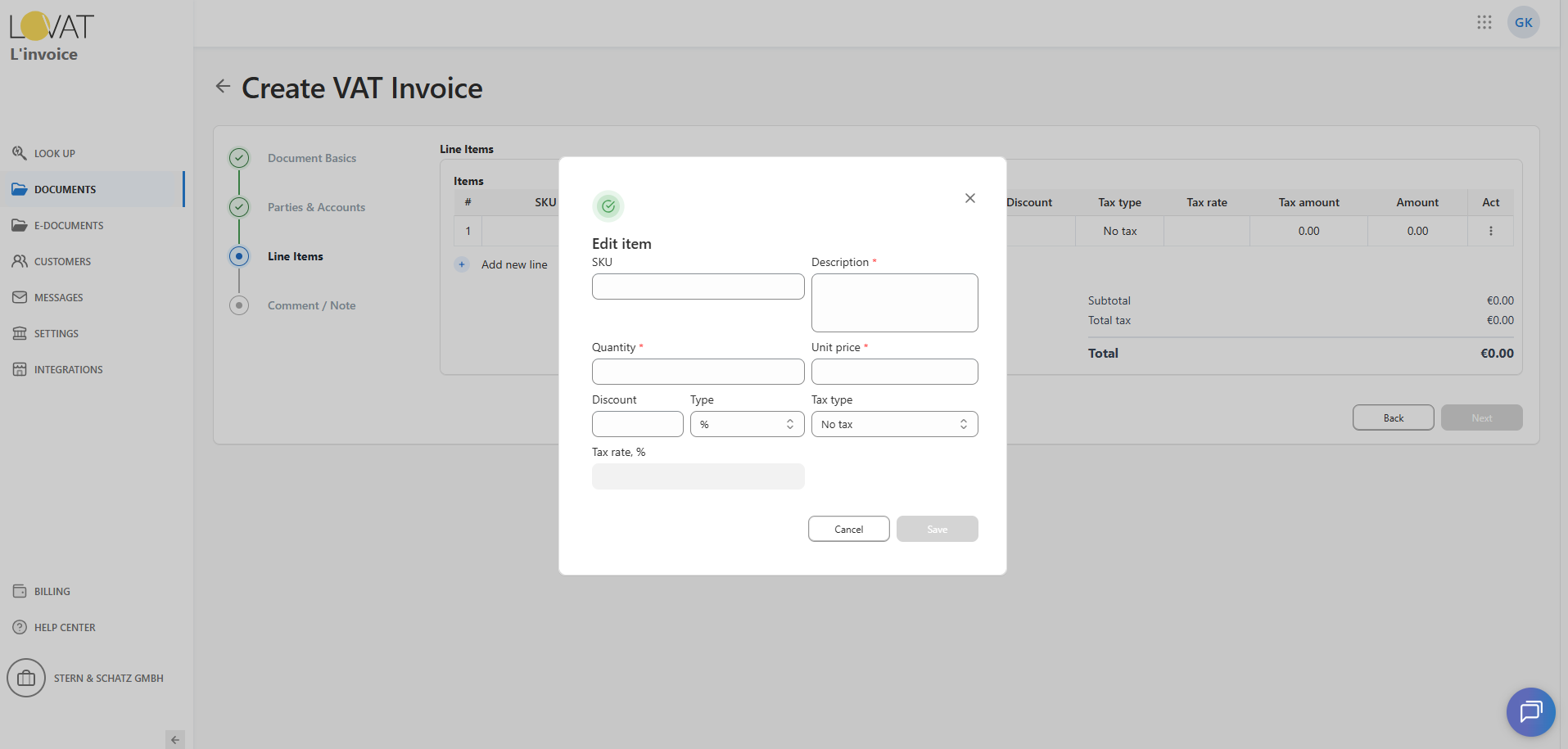

Opening the item modal

To enter or edit item details, click anywhere on the row.

This opens the item modal where you can specify all required and optional fields.

Item Modal — Required and Optional Fields

Mandatory fields inside the modal:

- Description* – name or details of the product/service

- Quantity*

- Price*

Optional fields:

- SKU

- Discount (amount or percentage)

- Tax information (Tax type, Tax rate, Tax amount depending on country rules)

Click Save to apply the values to the selected row.

Line Item Table Overview

Each created or updated line is displayed in the table with the following columns:

- # — item index

- SKU

- Description*

- Quantity*

- Price*

- Discount

- Tax type

- Tax rate

- Tax amount— calculated automatically

- Amount — calculated automatically

- Act — action menu (“…”)

Actions Available for Each Line

Click the “…” menu on the right side of a row to access:

- Edit — opens the modal to update the line

- Clone — duplicates the line with all its values (useful for similar items)

- Delete — removes the line from the invoice

Invoice Totals

All totals are calculated automatically based on the line items.

- Subtotal — sum of all item amounts before tax and discounts

- Discounts — if any line contains a discount (amount or percentage), the total discount is calculated automatically and displayed in the summary

- Total tax — sum of all tax amounts

- Total — final amount payable after applying discounts and taxes

Totals update dynamically whenever items are added, edited, cloned, or removed, or whenever discounts change.

Navigation

After adding at least one line, click Next to proceed.

Use Back to return to earlier steps.

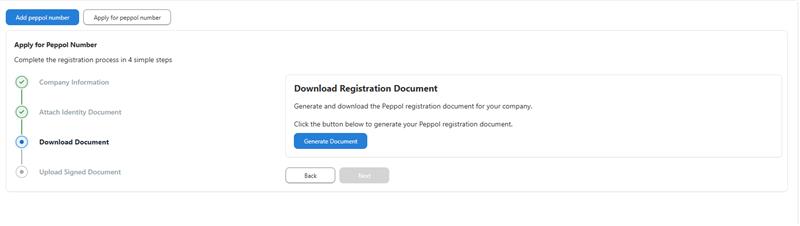

Option 2. Registering a New Peppol ID

Use this option if the client needs to register a new Peppol ID.

Step 1. Basic information

- In the first tab, provide:

- Company Name

- Country

- Identifier Type (several options are available)

- Identifier (e.g. VAT Number or another identifier)

- Click Next.

Identifier Types

The list of available Identifier Types depends on the selected country.

Each country may support its own national identifiers, while some identifier types are international and can be used across multiple countries.

Country-specific identifiers

Depending on the country, you may see local identifiers such as:

- VAT (e.g. France VAT Number)

- SIRET

- SIREN

- Other national business or tax identifiers

These identifiers are issued by local authorities and are commonly used for legal and tax purposes.

International identifiers

In addition, there are several international identifier types available for all countries, including:

- DUNS (Data Universal Numbering System)

- GLN (Global Location Number)

- LEI (Legal Entity Identifier)

- IBAN (Unique IBAN-based participant code)

⚠️ Note:

Although IBAN is available as an identifier type, it is not recommended for Peppol registration.

Recommendation

For Peppol ID registration, it is strongly recommended to use a VAT number whenever possible, as it is the most widely accepted and commonly used identifier for Peppol participants.

Step 4 — Comment / Note

In this final step, you can add any additional comments or notes that should appear on the invoice.

This section is optional, but it is commonly used to communicate payment terms, delivery details, legal notes, or any special information the recipient should be aware of.

How to use the Comment / Note field

You may enter:

- Payment terms (e.g., due dates, penalties for late payment)

- Legal or contractual information

- Customer-specific instructions

- Clarifications about services or products

- Internal reference notes that should appear on the final invoice

Example:

“This invoice must be paid by the due date stated above. Failure to remit payment on time may render the invoice invalid.”

Navigation and next steps

- Back — return to the previous step if you need to update any information.

- Save as draft — save the invoice without sending it. It can be edited later.

- Review & Send Invoice — proceed to the invoice preview, where you can double-check all details before sending or exporting.

Once the comment is added and you are satisfied with the invoice, click Review & Send Invoice to finalize the process.

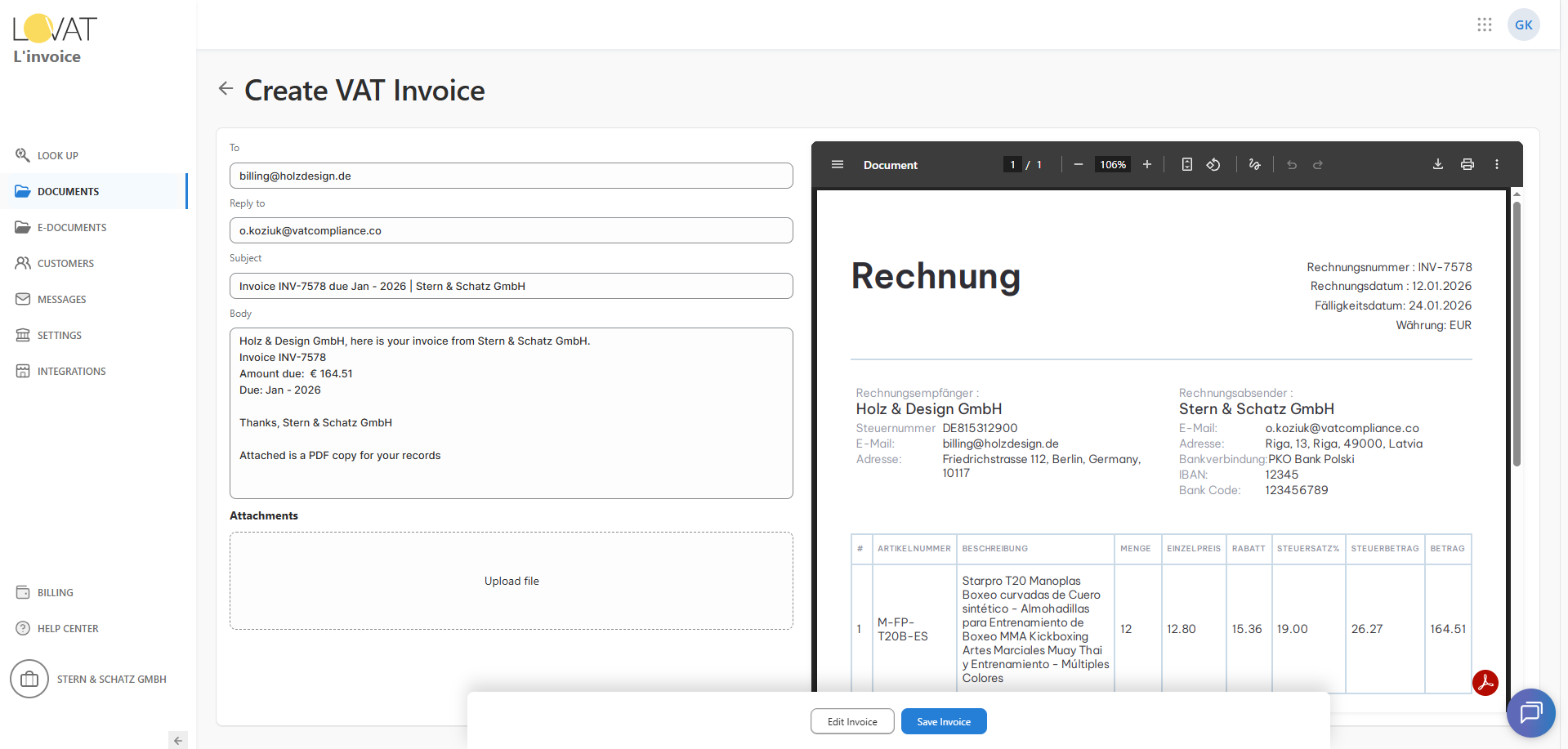

Final Step — Review & Send Invoice

In this step, you can review the invoice details and customize the email message that will be sent to the customer.

All fields in the email section — To, Reply to, Subject, and Body — are fully editable, allowing you to tailor the message before sending.

Email customization

You may adjust:

- Recipient address (To) — the customer’s email is pre-filled, but you can change it if needed.

- Reply-to address — defines where the customer’s response will be delivered.

- Subject line — automatically generated from the invoice number, but can be rewritten.

- Email body — includes a default message with the invoice amount and a friendly note; feel free to rephrase or add additional information.

Attachments (optional) can also be included by uploading files in the Attachments section.

Invoice preview

On the right side, you can see a real-time PDF preview of the invoice exactly as the customer will receive it.

This allows you to verify all amounts, customer details, tax information, and formatting before sending.

Save the invoice for next actions

When you click Save Invoice, the invoice is saved and becomes available for further actions, such as:

- sending to the customer via Email

- creating a structured e-document (e.g., Peppol / BIS, if applicable)

- downloading the PDF

- returning later for editing and final checks